Thank you to everyone who attended the PSPP employer year-end training session on September 27, 2022. A total of 57 participants representing 89% of PSPP employers attended – what a great turnout!

Your roles in the year-end process are very important to ensure timely and accurate data submissions toward your employees’ retirement benefits. The sooner that all employers’ year-end files are closed, the sooner PSPP can determine possible contribution changes and communicate that to you prior to finalizing budgets.

All of your favorite topics were reviewed including

- Testing data prior to year end

- Year-end submission

- Leaves of Absence

- Validations

- Remittances

- Reconciling & reports

- Closing & After-Closure Activities

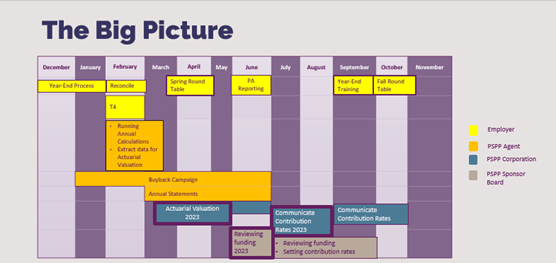

Next year, we are planning for a more streamlined valuation rate setting timeline: your help on ensuring the year end gets done on time this year will be even more important. We are shortening our timeline for the valuation to the end of May instead of June.

By doing so, our Sponsor Board will be able to look at the funding of the Plan in June instead of September. This will, in turn, provide us with an opportunity to communicate any contribution rates changes much earlier, around the beginning of July instead of September. The red outlined boxes show the proposed new dates coming in 2023. This in turn will give you more time to ratify your new upcoming budgets for the next year in 2024.

For further detailed information on this, keep your eyes on upcoming announcements in the Pension Dispatch. Until then, please refer to your PSPP Pension e-guide year-end section.