How is Your Pension Calculated

Calculating Your PSPP Pension

PSPP is a defined benefit pension plan, which means your pension is determined by a specific formula, not by the amount you’ve contributed. This formula considers your pensionable salary and years of service. So, the more you contribute and the higher your salary, the larger your pension will be.

Please check here if you are working part-time.

Estimating Your Pension

If you’re eager to get an estimate of your pension, we have the following tools available:

- Pension Estimator: This tool, available on our website, lets you play out various “what-if” scenarios. You can enter your own figures for salary and years of service to see how they might impact your pension.

- Pension Projection Calculator: This tool projects your future PSPP pension based on the pension information we have on file for you. You can access this calculator when you log in to Your Pension Profile.

Salary and Your Pension

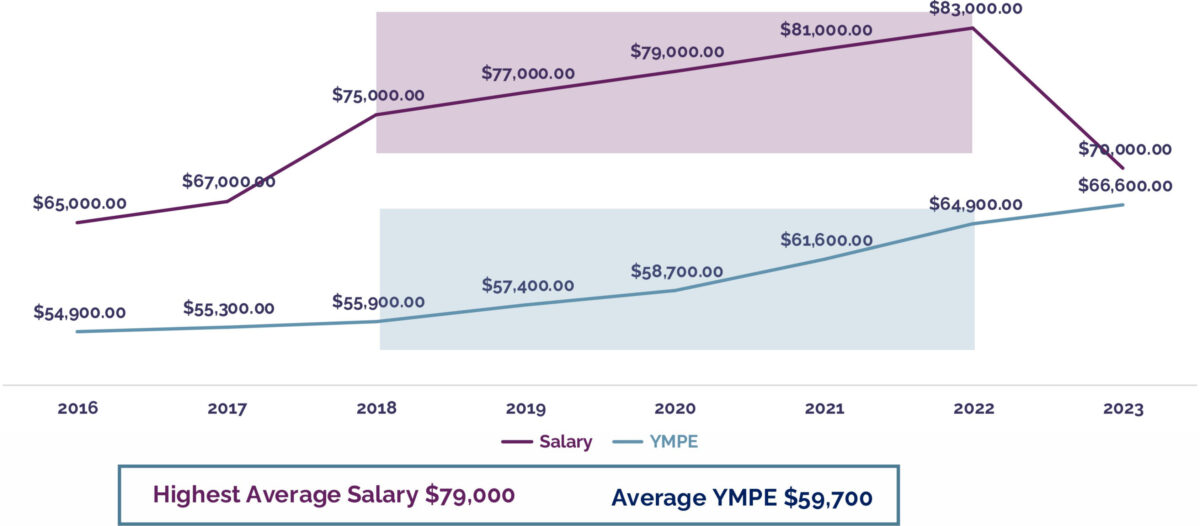

Your salary throughout your career is a key factor in calculating your pension. The plan uses your highest average salary, specifically, the best 5 consecutive years where your average pensionable salary was the highest. This period can occur at any point in your career, but for most members, it’s usually the last five years.

The pensionable salary used in the formula is your highest average salary, subject to an annual salary cap. For 2025, the salary cap is $209,223.50.

Service and Your Pension

The second factor in your pension formula is your Pensionable Service, up to a maximum of 35 years.

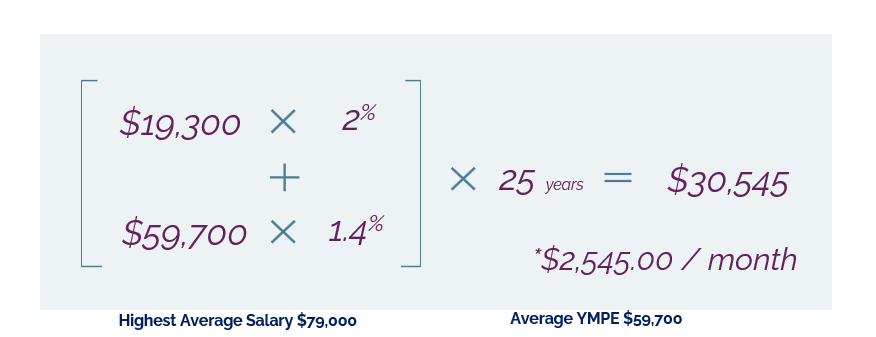

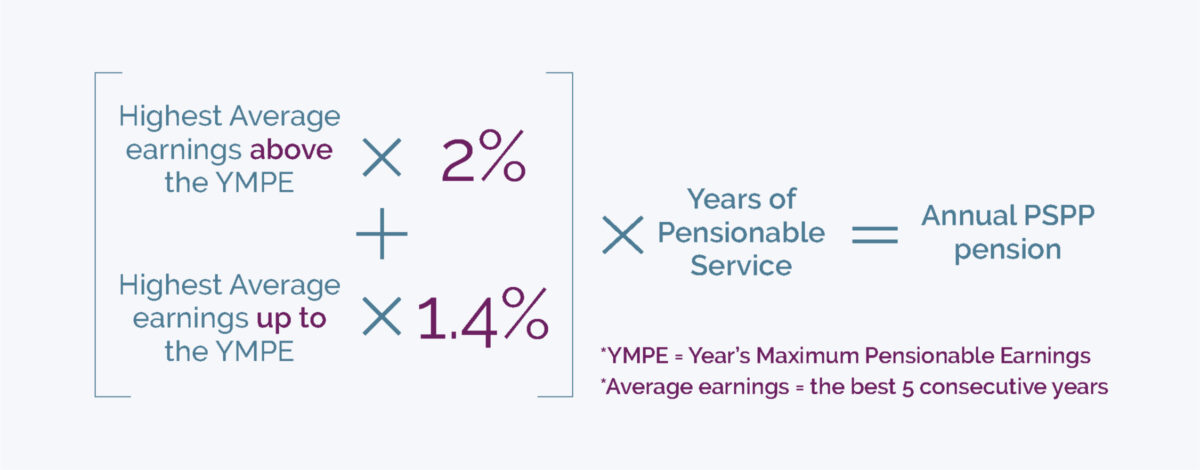

Your Pension Formula

In the pension formula, your highest average salary is divided into two parts: above and below the average Year’s Maximum Pensionable Earnings (YMPE). The YMPE amount used in your pension formula is averaged from the same years used to calculate your best five years. This YMPE average creates the dividing line in the formula between above and below YMPE.

The final amount of your pension depends on your age when you retire and your years of service. If you don’t have enough Pensionable Service and you’re under the age of 65, your pension could be reduced permanently.

Pension Calculation Example

- Member is 65 years old

- Member has 25 years of service

- Their highest average salary is $79,000

- The average YMPE was $59,700