Working Part-Time

On this page

It’s possible to work part-time and still be a member of PSPP, but it does impact your contribution and pension calculations.

Eligibility for Part-Time Employees

In the Plan, working fewer than 30 hours per week is considered part-time.

As a part-time employee, you are eligible to join the Plan if you:

- Are a permanent employee

- Work at least 14 hours per week, or 728 hours per year

- Meet the eligibility criteria set by your employer’s policy

Calculating Salary for Part-Time Employees

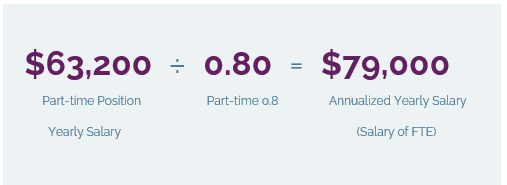

Salary for part-time members is annualized for contribution and pension benefit calculations.

Salary is annualized by dividing the salary earned by the pensionable service earned.

For example, if you work part-time working 80% of a FTE position and earn $63,200 per year, your annualized salary is $79,000.

Calculating Pensionable Service for Part-Time Employees

To calculate your pensionable service, the hours you worked are divided by the Full-Time Equivalent (FTE) hours. For example, if you worked 25 hours/ week and the FTE is 36.25 hours/week, pensionable service you earned is 0.80.

A full-time member typically earns one year of service per calendar year. A member working part-time will earn less service based on the percentage of full-time hours they work. If you work part-time for a PSPP employer, your service and salary are still components of your pension formula, but you won’t accumulate pensionable service as quickly as a full-time worker.

For example, If you worked a total of 25 years, part-time at 80% of a FTE position for each year, your total pensionable service earned is 20 years.

Calculating Contributions for Part-Time Employees

Your PSPP contributions are a percentage of your pensionable salary. The percentage is the same regardless of whether you are a part-time or full-time employee. The difference for part-time employees is how pensionable service impacts the calculation.

The salary is annualized for the contribution calculation. Contributions are calculated then prorated by multiplying the amounts by the pensionable service earned.

Example

- Part time salary – $63,200

- Full-time salary – $79,000

- $7,700 x 11.9% x 0.80 = $733.04

- $71,300 x 8.3% x 0.80 % = $4,734.32

- Your contributions = $5,467.36

- Employer contributions = $5,467.36

- Total – $10,934.72

Calculating Pension for Part-Time Employees

Service and salary remain the foundation of PSPP’s pension formula, even when you work part-time.

Example

- Member is 65 years old

- Member has worked for 25 years at an 80% FTE position for each year

- Pensionable service: 20 years

- Their highest 5’year average annualized salary is $79,000

- The average YMPE was $59,700

Working Multiple Part-Time Positions

If you work in multiple part-time positions, we will combine your service up to a maximum of 100% or 1 year of service credit. If you make any overpayments into the Plan, exceeding the allowable 1 year of service credit, these will be returned to you by one of your employers in the new year after they complete their Year End reporting.