When Can I Retire?

The date you choose to begin your pension is up to you and can depend on a lot of factors, such as the health of you and your pension partner, your financial situation, the standard of living you want in retirement, and how long you want to continue working.

The amount of your monthly pension will be different depending on the date you choose to start your pension. Your selected date will determine your age at retirement and may impact your highest average salary and how much service you’ve accumulated in the Plan at retirement. These are key components that are used in the calculation of your pension. Your final monthly pension also depends on the pension option you choose.

In the Plan, normal retirement age for members is 65 years of age. If you are actively working and contributing to the plan at age 65, you qualify for an unreduced pension, even if you are not Vested. If you are a deferred or inactive member and you are vested because of your previous service, you also qualify for an unreduced pension at age 65. The earliest a vested PSPP member can begin their pension is age 55 on their birthday

Early Retirement & Reduced Pension

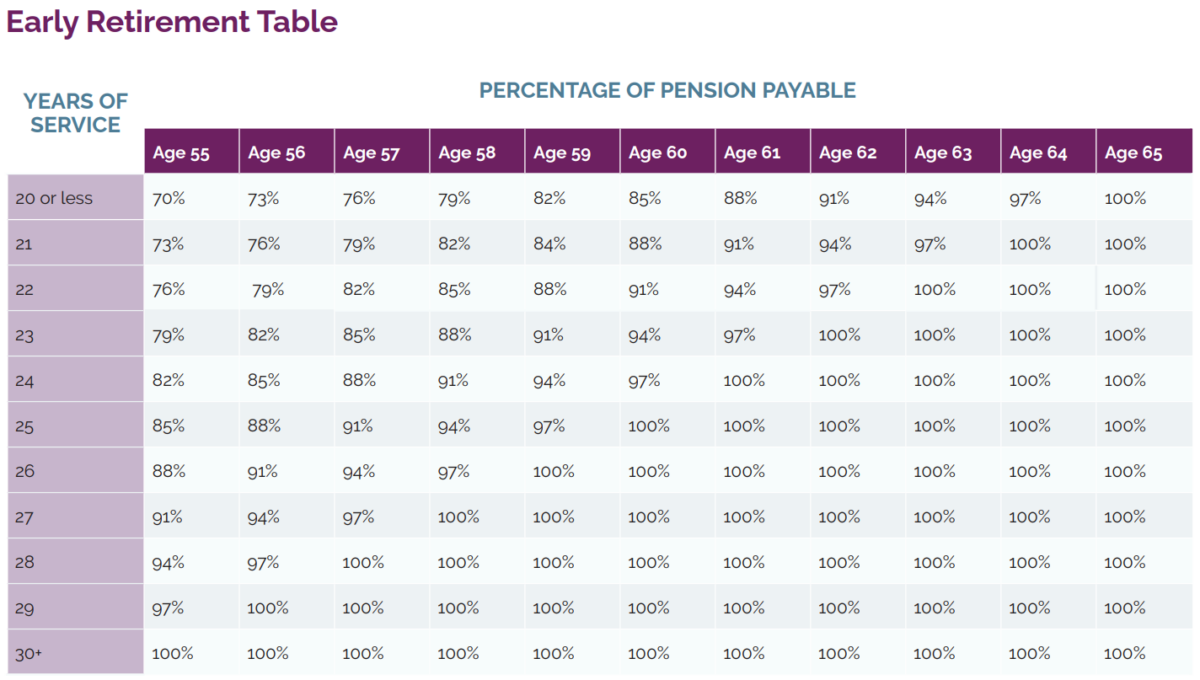

In an early retirement, a reduction only applies if you have not reached your 85 Factor. The early retirement reduction amount is 3% per year multiplied by the lower of:

• The number of years it would take you to reach age 65, or

• The number of years until you reach the 85 Factor.

The maximum reduction that can be applied to your pension is 30%. When we reduce a pension, the plan will consider whichever rule will benefit you more. This means if you meet your 85 Factor sooner than you will reach the age of 65, we will use that reduction. If you reach the age of 65 first before your 85 Factor, we will use that reduction instead.

What is the 85 Factor? (85 Points)

The 85 factor is calculated by adding together your age and years of service at retirement. If the total equals at least 85 points, you’re entitled to an unreduced PSPP pension as early as your 55th birthday.

Postponed Retirement

You can continue to work past 65 years of age if you choose. If you haven’t reached 35 years of service, you can continue to build your pension. The maximum age you can delay your pension to is December 31 of the year you turn 71. This is an Income Tax Act rule, all pensions in Canada must be started on or before this date.

Pension Reduction Example

If you retire early—before age 65 or before reaching your 85 factor—your monthly pension amount will be reduced.

The early retirement reduction amount is 3% per year multiplied by the lower number of:

- the number of years it would take you to reach age 65, or

- the number of years until you reach 85 points.

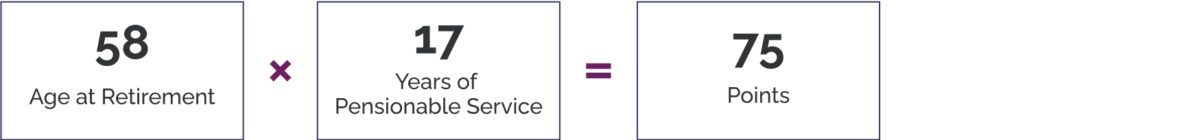

Here is an example of how early retirement reduction is calculated:

Step 1

Calculate the number of years it will take for the member to reach age 65 and the number of years until they reach 85 points.

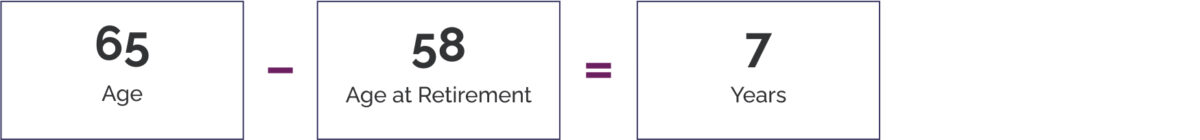

Step 2

Use the lower number (7 years) to calculate the total pension reduction rate.

When Should I Retire?

Use the Pension Projection Calculator in the online portal, Your Pension Profile, to estimate different dates and pension options impact your monthly pension.

More about Retirement Planning